APIs > Loan Details API

Loan Details API

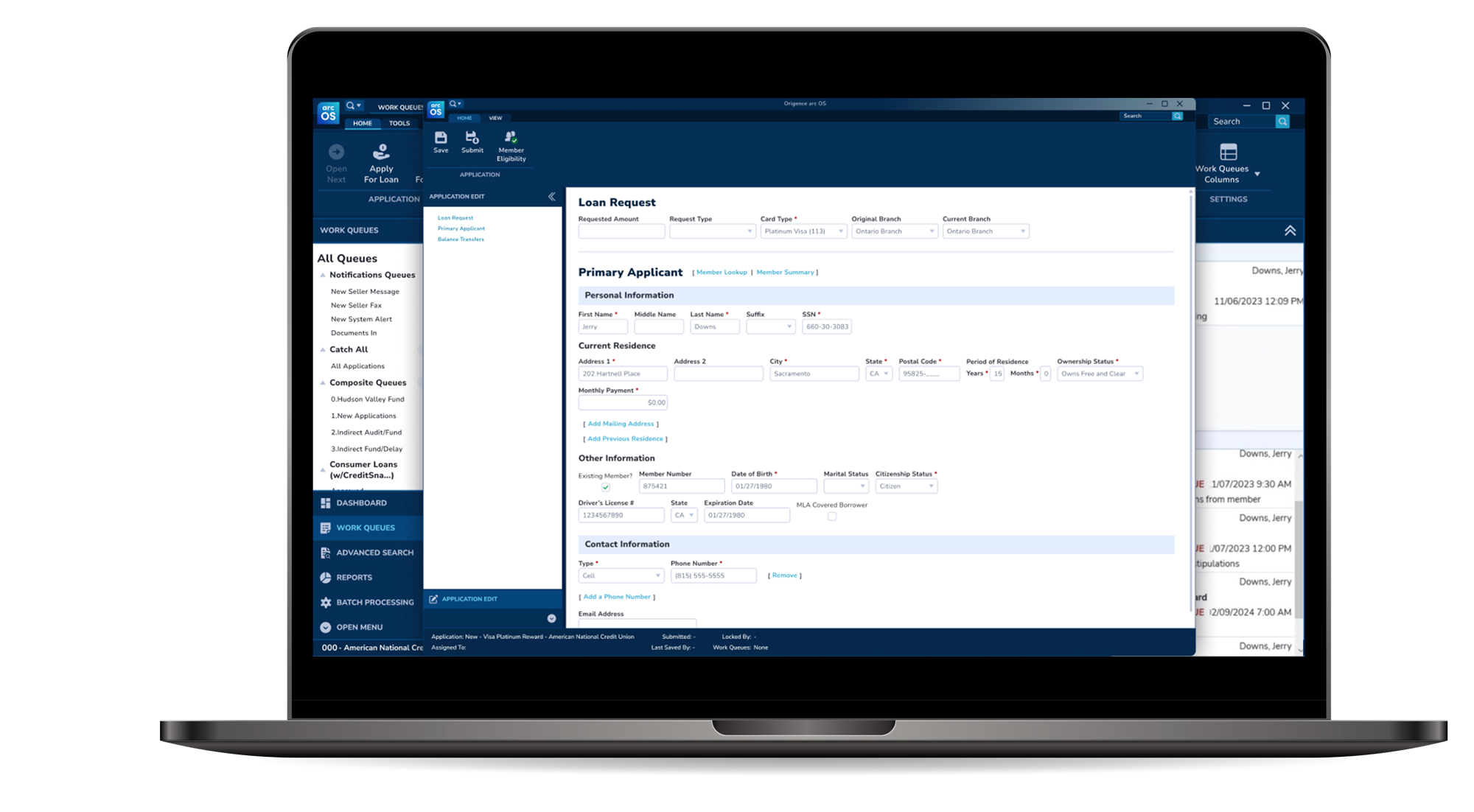

Lenders can listen for specified real-time webhook event notifications and programmatically request additional application details for each individual application.

Webhook notifications deliver real-time updates for key events such as work queue changes, funding alerts, decision outcomes, and other important system activity. For each event, the API provides on-demand, real-time access to detailed, loan-level information beyond what is included in the webhook payload, or you can call the API directly as needed.

Event notifications

Receive instantaneous webhook event-driven notifications from arc OS in real-time.

Data retrieval

Retrieve real-time loan level data and details through a unified API.

Security

Implement token-based authentication to ensure secure and authorized access.

Versioning

Supports versioning to ensure backward compatibility as the API evolves over time.

how it works

The Loan Details API brings together real-time webhook event notifications and data retrieval in a single API for simplicity and improved risk management.

■ Quickly subscribe to and receive webhook notification updates at a loan level in arc OS:

■ New application

■ New decision

■ Application withdrawn

■ New loan comment

■ Stipulation complete

■ Application funded

■ New loan document

■ Application has been exported to host

■ Application work queue changed

■ Retrieve real-time loan related details

■ Enhance efficiency and gain access at a loan-level

■ Seamless data transfer and synchronization

■ External system authenticates itself using API keysken

Use Case

A loan officer or lender partner wishes to inquire about the status of a loan application and retrieve information regarding applicants, loan specifics, collateral, approval status, and additional details.

This streamlined process is enabled by utilizing the capabilities of the arc OS API through an external system.

Lender benefits

Seamless integration

A well-designed Loan Details API facilitates seamless integration with your CRM or external system. This means you can easily incorporate the API into your existing infrastructure without major disruptions, ensuring a smooth workflow.

Automation and efficiency

Automated document upload and download processes save time for both users and system administrators, improving overall efficiency.

Timely updates

The API provides real-time event status notifications, enabling your external system to receive immediate updates on loan status changes. This ensures that you are always working with the latest and most accurate information.

Customized data retrieval

The API allows you to retrieve specific loan information based on your needs. This customization ensures that you only receive the data relevant to your business processes, optimizing the efficiency of your external system.

Enhanced decision-making

Access to current and detailed loan information empowers you to make informed decisions quickly. Whether it's assessing funding alerts, work queue changes, or decision alerts, having up-to-date data at your fingertips enhances your ability to respond effectively.

Cost-effective solution

Automating data updates through the API reduces the need for manual intervention, ultimately saving time and resources. This cost-effective solution allows you to allocate resources more efficiently and focus on strategic aspects of your business.

Ready to get started?

To begin utilizing our API services, simply register for an account.

For step-by-step details, check out our Quick Start Guide.

Contact Us

© 2024 Origence. Products or solutions referenced may be trademarks or registered trademarks of their respective companies.